Client Money Handling Procedures

Client

A member of the public who is a client of the company (Leapfrog Lettings and Sales trading as Leapfrog Lettings Limited). This could be in the form of a person ( tenant or landlord), company, trust, body corporate or another organisation

Client Money

Client money is money of any currency, which can be in the form of cash, cheque, draft or electronic transfer which is held by Leapfrog as a stakeholder, and which is not immediately due or payable to Leaprog for its own account.

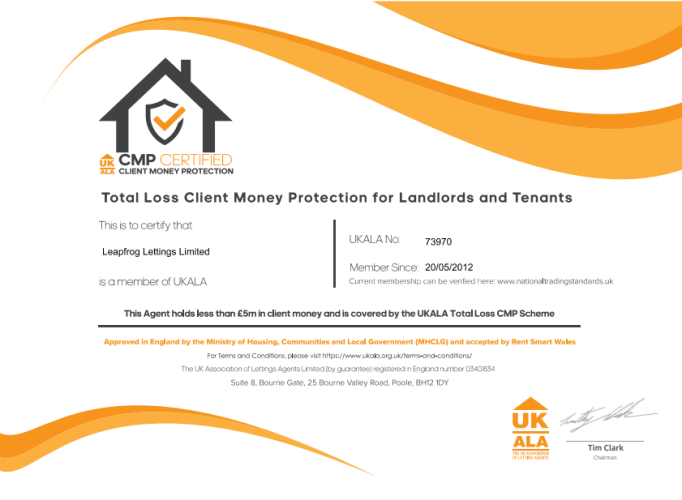

Scheme Member:

UKALA Client Money Protection membership number 73970

Compliance

The written procedures are set forth to ensure compliance with The Client Money Protection Schemes for Property Agents (Approval and Designation of schemes) Regs 2018 and any other Regulations and statutory requirements as necessary and to maintain best practice.

Handling of Client Money – written procedures

Leapfrog Lettings and Sales will operate the following policy to preserve the security of client’s money as part of its business operations:

1. Client Money Account

a) Leapfrog holds and maintains one or more separate client bank accounts which are solely for the use of client’s money.

b) The said bank accounts include in their title the word “client” and include the company name.

c) The accounts are easily distinguished from other accounts, such as office accounts, which are named as so.

d) We have written confirmation from the Banks that they acknowledge that monies in the client account must not be combined with, or transferred to, any other account maintained by the company. The said banks shall not be entitled to exercise any right to set off or counterclaim against the money in that Client Money Account in respect of any sum owed to it in respect of any other account held by the company.

e) We keep records and accounts which show all dealings with Client Money. We can demonstrate that all Client Money held by the company is held in a Client Money Account.

f) Our client bank accounts are reconciled on a daily basis, we maintain details and records for all dealings with client money to ensure clarity, accuracy and completeness

2) Client Money Controls

a) We hold client monies in UK banking institutions as authorised by the Financial Conduct Authority that are covered by the Financial Services Compensation Scheme and ensure that funds are available within a maximum of 31 days. Currently all client monies are held with The National Westminster Bank.

b) Our software systems identify all receipts and payments relating to the client accounts i.e., the client’s ledger showing cash balances

c) All client ledgers are clearly named with the client’s name and property address

d) Our accounting procedures, systems and data are securely controlled and protected for access, back-ups, firewalls and recovery.

e) Only nominated and authorised staff deal with client money. A principal or appropriately qualified person oversees the client accounting function. There is adequate cover for holiday and sickness periods.

f) Mixed monies are initially paid into the client accounts and the office element is paid into the office account when it is due

g) Fees for the office account which may have been received in advance are paid into the client account pending completion of work

h) Duplicate receipts are issued for all cash received

i) We have clear procedures in place to distinguish between client and office money

j) We will pay any client monies received by cheque, cash or draft into the designated client bank account within 3 business days of receipt. Unbanked client monies are kept secure.

k) Authorisation and supervision are in place for payments made by cheque or bank transfer and other electronic methods. We do not sign blank cheques and unused cheques are stored in a secure place.

l) We repay client money without delay, if there is no longer a valid requirement for us to retain it, if the client requests its return.

m) Effective controls are in place over the setting up of new client and supplier accounts on the system.

n) Cash payments are discouraged, where possible.

o) We hold and maintain a Professional Indemnity Insurance Policy that is appropriate for the business and size of the company.

p) Our policy and procedures for handling client money are published on our website.

q) We will ensure that there are always sufficient funds in the client accounts to pay amounts owing to clients, as they fall due under the terms of business, as agreed and signed with the client